How to Read Your Paystub (Beginner Guide)

Getting your first paycheck feels amazing — until you look at the numbers and think: “Wait, where did all my money go?” Don’t worry, you’re not alone. Learning how to read your paystub can feel confusing at first (hello, random abbreviations and tiny print), but once you know what to look for, it actually tells you a lot about where your money is going.

Let’s break down how to read your paystub the easy way.

First Things First: What’s a Paystub?

Your paystub is basically a receipt for your paycheck. If you’re figuring out how to read your paystub, this is where it starts.

It shows:

- How much you earned

- What deductions were taken out

- How much you actually get to take home

Even if you use direct deposit and never see a paper check, you still have an online paystub to review.

✅ Pro-tip: Always look at it, especially when you’re first starting, to catch mistakes early if something’s wrong.

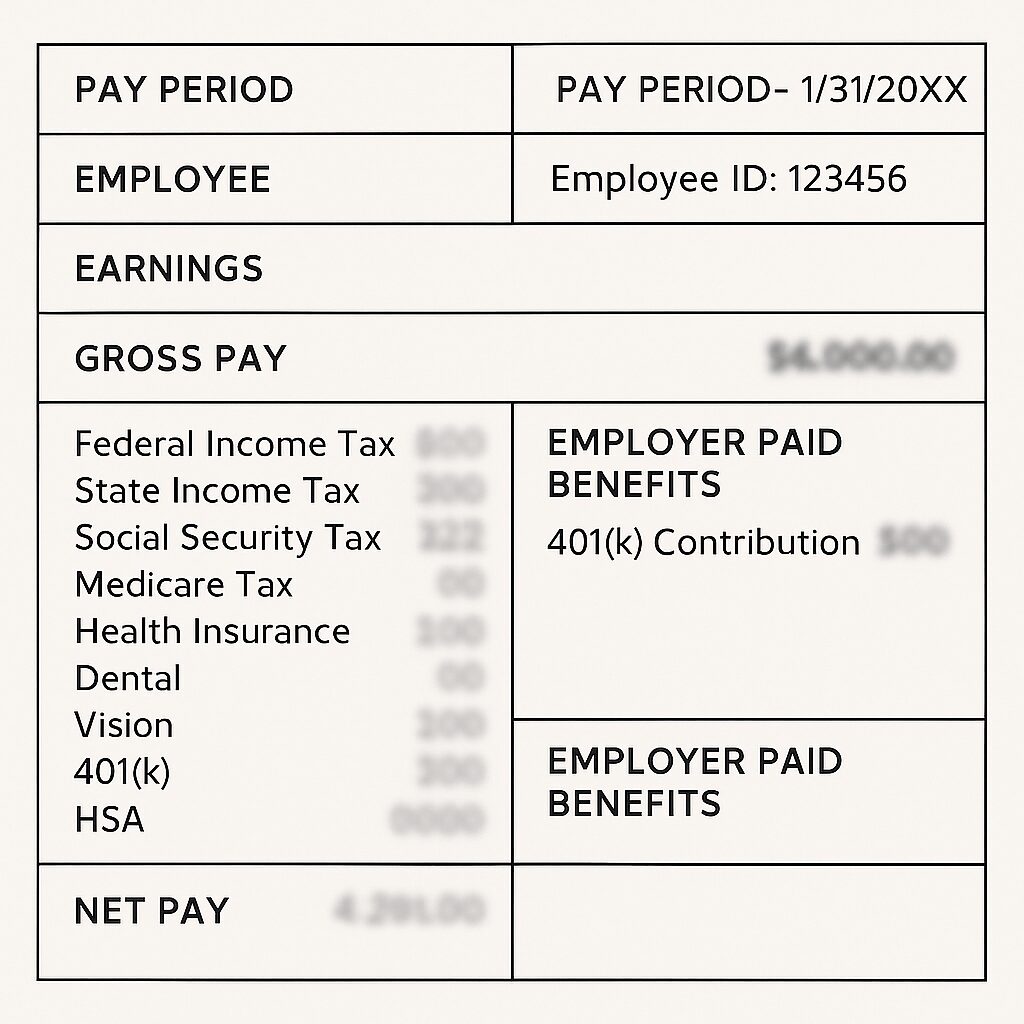

What You’ll See on a Typical Paystub

Here’s what’s usually listed (and what it actually means when you’re learning how to read your paystub):

1. Gross Pay

Gross pay = the total amount you earned before anything is taken out.

Example: $20/hour × 40 hours = $800 gross pay.

This number looks nice — but it’s not what you take home.

2. Net Pay (a.k.a. Take-Home Pay)

Net pay = what’s left after taxes, insurance, and other deductions. This is the number you’ll actually use to budget.

Example:

- Gross Pay: $800

- Deductions: $200

- Net Pay: $600

✅ Pro-tip: Always budget based on your net pay!

3. Taxes Withheld

Another important part of how to read your paystub is understanding taxes.

Your employer takes out:

| Tax Type | What It Covers |

| Federal Income Tax | Taxes for the U.S. government |

| State Income Tax | Taxes for your state (if applicable) |

| Social Security Tax | Funds retirement benefits |

| Medicare Tax | Funds healthcare for people 65+ |

✅ Pro-tip: If your tax withholding looks wrong, check your W-4 form with HR.

4. Benefits Deductions

When figuring out how to read your paystub, you’ll also notice deductions for benefits like:

- Health, dental, and vision insurance

- Retirement contributions (like your 401(k))

Example:

- If you signed up for health insurance, expect to see a small deduction each pay period.

- If you enrolled in a 401(k), look for your contribution AND any employer match (free money!).

5. Other Deductions

Depending on your setup, you might also see:

- HSA (Health Savings Account) contributions

- FSA (Flexible Spending Account) contributions

- Union dues

- Wage garnishments

✅ Pro-tip: Always ask questions if something looks weird! Part of how to read your paystub is protecting your paycheck.

What to Check Every Time (Quick Checklist)

When you review your paystub, double-check:

- Net Pay vs. Gross Pay

- Tax Withholding Amounts

- Health Insurance and Benefit Deductions

- Retirement Contributions (like 401(k) or HSA)

- Employer Contributions (FREE money!)

- Strange Deductions You Don’t Recognize

The more familiar you are with how to read your paystub, the easier it gets to spot problems fast.

Why It Matters

Knowing how to read your paystub helps you:

- Spot mistakes early before they cost you.

- Understand your real paycheck (net vs gross).

- Maximize your job benefits.

- Budget smarter and with real numbers.

It’s one of those small habits that builds big financial confidence over time.

How Often Should You Review Your Paystub?

When you start a new job (or change your benefits), it’s smart to check your paystub closely for the first few pay periods — just to make sure your pay, tax withholdings, and any deductions (like health insurance or 401(k)) are correct. After that, doing a quick review once every month or two is plenty for most people. Think of it like a financial oil change. Regular check-ins help you catch any mistakes early without stressing yourself out.

Bottom Line

Learning how to read your paystub is one of the smartest early money moves you can make. It gives you more control over your money, helps you spot hidden opportunities (like free employer matches!), and keeps your financial foundation strong. Even though it seems like a boring chore now, your future self (and your bank account) will thank you!

You’ve got this! And Mrs. Money Sidekick is here to cheer you on every step of the way.

On your side,

Mrs. Money Sidekick

P.S. Interested in more simple starting-out tips to help build your financial foundation? Check out our Starting Out posts here!

One Comment